Smart Grid companies raise $316 million; Energy Efficiency companies raise $109 million

Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and mergers & acquisitions (M&A) activity for the Battery Storage, Smart Grid, and Energy Efficiency sectors for the first quarter (Q1) of 2022.

To get a copy of the report, visit: https://mercomcapital.com/product/q1-2022-funding-and-ma-report-for-storage-grid-efficiency

In Q1 2022, $1.6 billion was raised in VC funding by Battery Storage, Smart Grid, and Energy Efficiency companies, a 21% increase compared to the $1.3 billion raised in Q1 2021.

Battery Storage

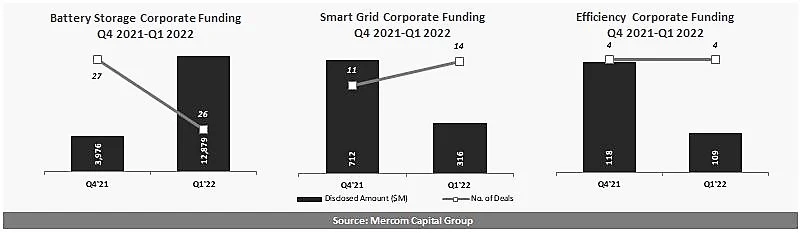

Total corporate funding (including VC, Debt, and Public Market Financing) in Battery Energy Storage came to $12.9 billion in 26 deals compared to $4 billion in 27 deals in Q4 2021. Funding was up significantly year-over-year (YoY) compared to $4.7 billion in 18 deals in Q1 2021.Venture capital (VC) funding (including private equity and corporate venture capital) raised by Battery Storage companies in Q1 2022 came to $1.1 billion in 21 deals a 15% increase compared to $1 billion in 14 deals in Q1 2021. Quarter-over-quarter (QoQ) funding was 28% lower compared to $1.6 billion in 21 deals in Q4 2021.

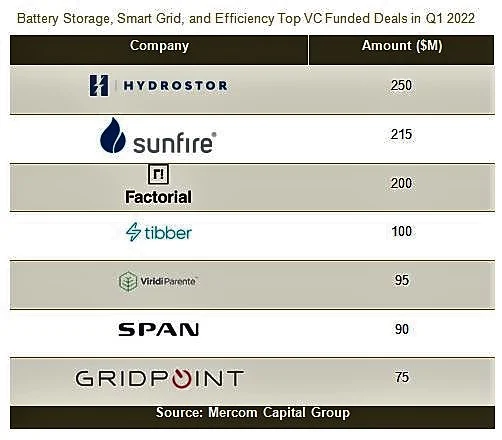

The top-5 VC funded Battery Storage companies this quarter were:

- Hydrostor, which raised $250 million from Goldman Sachs Asset Management;

- Sunfire raised $215 million from Copenhagen Infrastructure Energy Transition Fund I and Blue Earth Capital;

- Factorial Energy raised $200 million from Mercedes-Benz (DAI) and Stellantis;

- Viridi Parente raised $95 million from Thomas Golisano, Ashtead Group/Sunbelt Rentals, and National Grid Partners;

- Our Next Energy (ONE) raised $65 million from BMW i Ventures, Coatue Management, Breakthrough Energy Ventures, Assembly Ventures, Flex, and Volta Energy Technologies.

In Q1 2022, announced debt and public market financing for Battery Storage technologies were higher, with $11.7 billion in five deals compared to $2.4 billion in six deals in Q4 2021 and $3.7 billion in four deals in Q1 2021.

There were five M&A transactions involving Battery Storage companies in Q1 2022. In Q4 2021, there were nine M&A transactions. YoY, there were four Battery Storage M&A transactions in Q1 2021.

There were 13 Battery Storage project M&A transactions in Q1 2022.

|

Smart Grid

Total corporate funding in Smart Grid was 7% higher, with $316 million in 14 deals compared to $295 million in 11 deals in Q1 2021.

VC funding for Smart Grid companies increased 9% in Q1 2022 with $312 million in 12 deals compared to $287 million in 10 deals in Q1 2021.

The top-5 VC funded Smart Grid companies included:

- Tibber, which secured $100 million from Summa Equity.

- SPAN raised $90 million from Fifth Wall Climate Tech, Wellington Management, Angeleno Group, FootPrintCoalition, Obsidian Investment Partners, A/O PropTech.

- Utilidata raised $27 million from Moore Strategic Ventures, Microsoft Climate Innovation Fund, NVIDIA, Keyframe Capital, Braemar Energy Ventures, MUUS Asset Management;

- David Energy raised $21 million from Keyframe Capital, Union Square Ventures, Equal Ventures, Box Group, MCJ Collective, Toba Capital, Turntide, James Dice.

- JET Charge raised $18 million from RACV, Clean Energy Innovation Fund, Claremont Capital, Greg Roebuck, Simon Monk.

Four million dollars was raised in two debt and public market financing deals in Q1 2022. There was one $484 million public market financing deal in Q4 2021. Year-over-year, $8 million was raised in one public market financing deal in Q1 2021.

In Q1 2022, there were three M&A transactions compared to two in Q4 2021 and six transactions in Q1 2021.

Energy Efficiency

Total corporate funding in Energy Efficiency came to $109 million in four deals compared to $118 million in the same number of deals in Q4 2021. In a YoY comparison, $5 million was raised in one deal in Q1 2021.

VC funding raised by Energy Efficiency companies in Q1 2022 came to $109 million in four deals compared to $118 million in four deals in Q4 2021. In a YoY comparison, $5 million was raised in one deal in Q1 2021.

Thirteen investors participated in VC funding this quarter.

There were no Efficiency M&A transactions in Q1 2022. There was one M&A transaction in Q4 2021. In Q1 2021, there was one M&A transaction for $300 million.

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.

ليست هناك تعليقات

إرسال تعليق