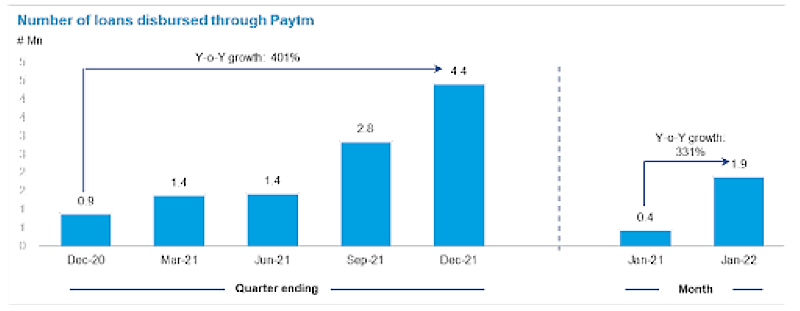

Lending business scales to 1.9 million loan disbursals during the month, y-o-y growth of 331%; aggregating to a total value of INR 921 Cr (y-o-y growth of 334%)

Offline payments leadership strengthens further; number of devices deployed stands at 2.3 million

Highest ever growth in average monthly transacting users (MTU) at 68.9 million, up 40% y-o-y

Over 105% Y-o-Y increase in GMV, which is the merchant payments processed through all instruments (Paytm Wallet, Paytm Payments bank account, other banks netbanking, credit and debit cards, UPI etc), at INR 83,481 Cr ($11.2 billion)

One97 Communications Limited (OCL) that owns the brand Paytm, India’s leading digital payments and financial services company, has today shared its business updates for January, 2022. The company has witnessed accelerated growth in its lending business, while it further deepens its leadership in the offline payments segment, which has resulted in the highest ever growth in Monthly Transacting Users and continued growth in its GMV.Paytm spokesperson said, “Paytm is witnessing a broad growth across our platform as we continue to register increased adoption of our lending products, Paytm Postpaid (BNPL), merchant loans and personal loans. We are also continuously expanding our offline payments business, with more devices being deployed across the country. Our efforts are seen in the trust our consumers and merchants place in us, as we see record user engagement on the platform.”

Lending witnesses accelerated adoption: Number of loans disbursed through our platform grew 331% y-o-y to 1.9 million loans in Jan 2022, while the value of loans disbursed was Rs 921 Cr, an increase of 334% y-o-y. The business saw increased adoption of our lending products, despite some temporary impact of Omicron over a short period of time on merchant lending disbursal volumes.

|

|

105% y-o-y growth in GMV: GMV processed through our platform during January-22 aggregated to approximately INR 83,481 Cr ($11.2 billion).

|

Records highest-ever user engagement: Average monthly transacting users (MTU) in Jan 2022 were 68.9 million, growth of 40% Y-o-Y.

|

| 1. Average MTUs for a quarter is the average of MTUs for each month in the quarter |

Over 2.3 million devices deployed across the country as of the end of January 2022, a measure of our offline payments leadership.

|

The table below summarizes the key operating metrics as highlighted above.

Notes:

Exchange rate used $1 = INR 74.5

GMV is defined as the value of total payments made to merchants through transactions on our app, through Paytm payment instruments or through our payment solutions, over a period. It excludes any consumer-to-consumer payment services such as money transfers

MTU: Monthly Transacting User or unique users with at least one successful transaction in a particular calendar month

Total loans disbursed by financial institution partners through our platform include both consumer loans and merchant loans, and excludes the number and the value of loans sourced by third parties through advertising on our platform, and aggregation of EMIs on our POS devices

About Paytm:

Paytm is India’s leading digital payments and financial services company, which is focused on driving consumers and merchants to its platform by offering them a variety of payment use cases and then cross-selling them higher margin financial services products. Paytm offers a) payments to consumers and merchants, b) financial services, particularly lending, and c) other merchant services (Commerce and Cloud).The company provides consumers with services like utility payments and money transfers, while empowering them to pay via Paytm Payment Instruments (PPI) like Paytm Wallet, Paytm UPI, Paytm Payments Bank Netbanking, Paytm FASTag and Paytm Postpaid - Buy Now, Pay Later. To merchants, Paytm offers acquiring devices like Soundbox, EDC, QR and Payment Gateway where payment aggregation is done through PPI and also other banks’ financial instruments. To further enhance merchants’ business, Paytm offers merchants commerce services through advertising and Paytm Mini app store. Operating on this platform leverage, the company then offers credit services such as merchant loans, personal loans and BNPL, sourced by its financial partners.

.jpg)

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.

No comments

Post a Comment