From a real estate perspective, startups are becoming a force to reckon with. As startups continue to take up more space in commercial offices, commercial real estate will have to adapt to cater to the needs of startups. Managed spaces are also observing more traction from startups not only in metro cities, but in non-metro cities as well.

Leading diversified professional services and investment management company, Colliers along with CRE Matrix have jointly released a report , ‘Startups Scale Up’, that states that the startups’ footprint has quadrupled over the last 5 years, contributing 10% to office occupancy today vs 3% in 2016.

"Startups to lease 29 million sq ft of space during 2022-24; amongst the fastest growing occupier sectors," said the report.

|

While global companies, followed by Indian conglomerates, remain the largest occupiers of commercial office space, startups are leasing space at a rapid pace. Startups have shown highest growth rate of 38% in the last 12 years in total occupied space as compared to other office occupiers. This is not only led by rapid expansion of existing startups, but also new enterprises.

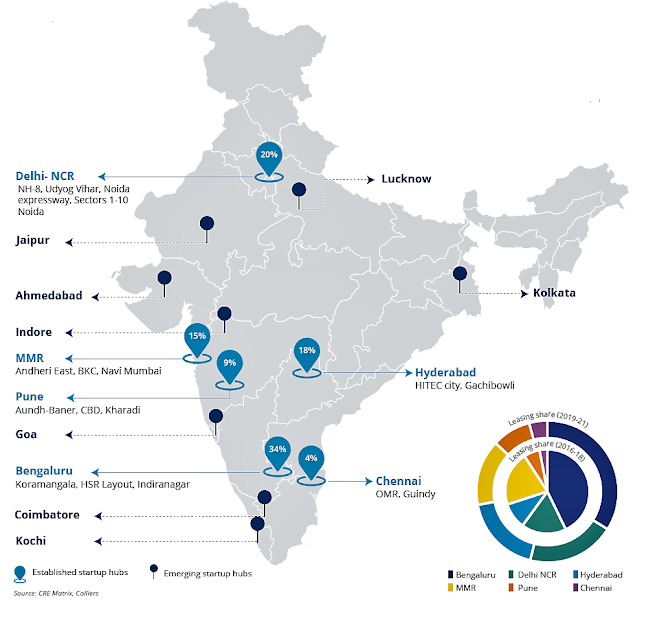

About 49.7 million sq. ft. of space is occupied by startups as of 2021 across the top six cities - Bengaluru, Chennai, Delhi-NCR, Hyderabad, Mumbai and Pune, said the CRE Matrix-Colliers report.

|

Delhi-NCR is amongst the fastest-growing market in terms of leasing by startups. Delhi-NCR witnessed a three-fold increase in leasing by startups during 2021 on a YoY basis. The region benefits from being a catchment for education institutions in the North and East India, and strong infrastructure.

|

|

Startups' Choices of Leasing

Plug & Play offices - High prices can be a challenge for startups since many are constrained by limited

cashflows or access to capital. Startups typically prefer plug and play flex space.

Collaborative culture - Informal spaces and interactive areas in the workspace.

Scalability - Startups are volatile in nature and may scale up and down quickly. Hence, they prefer spaces with expansion options

Standard deal size

- Early-stage startups - 5,000-10,000 sq ft

- Late-stage startups – 30,000 – 35,000 sq ft

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.

IndianWeb2.com is an independent digital media platform for business, entrepreneurship, science, technology, startups, gadgets and climate change news & reviews.

No comments

Post a Comment